Finding the best bank accounts in the UK can be a daunting task. Take a look at our top tips to help you succeed and use these elements to choose your bank.

Current accounts in 2015

Opening a current account is a matter of prioritising the features you need. For students or recent graduates, an interest-free overdraft is essential. If you are always in credit, find account which pays the most interest on your bank balance. Many vendors offer online banking and paperless statements, which is environmentally friendly and convenient. Indeed, you are likely to set up an account like this:

- Create an account with your bank of choice, and register for online banking.

- Sign into your account using log in details provided by the bank.

- Check your balance, transfer money, set up direct debits – all of the usual banking actions can be done through your online account!

However, if you envisage needing paper statements or prefer talking in-branch, make sure there are facilities for this before committing to an account.

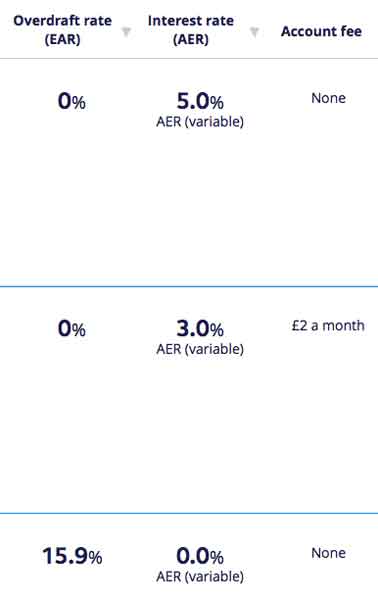

To compare bank opportunities, check overdraft and interest rates. Don’t forget Account fees

For child accounts, keep in mind that the usual minimum age is 11, with more advanced options for 16 year olds and older. Accounts of this type usually allow you to limit how much can be withdrawn using a cash card and monitor transactions with a debit card.

Many banks offer ‘basic’ bank accounts that do not come with benefits like overdrafts or any credit, but will allow you to store money and buy products online and in-store using a debit card. Though suited best for bad credit scorers, they’re actually available for anyone; all you need is ID and proof of address. But remember, no overdraft facility means that if you over-spend, there will be hefty fees. Equally, don’t open a basic account with a bank you are already in debt to – they may take your funds without warning.

There are even accounts specifically designed for charities and clubs. These often accrue more interest than the usual accounts, with lower tariffs, so again it’s worth searching around for a bank account that suits the type of transactions you will be making.

Choose your best savings account.

The key features to compare with savings accounts are interest rates, withdrawal fees, and whether either of these will change after a set amount of time.

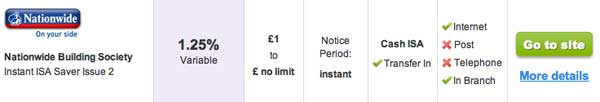

Have a lookup for Nationwide Bank conditions. Never hesitate to read all terms conditions before subscribing.

- If your intention is to keep your savings untouched to gather interest, an ISA might be your best bet. They are tax-free, but making a withdrawal can be complicated and time-consuming, such as having to send off for permission via post. A bond is also an option, inaccessible but accumulating interest rapidly.

- However, if you’re saving with something in mind or expect to be dipping into your account occasionally, try an easy access account for savings. Fees for withdrawing money are minimal but the interest rates are much less appealing than the above.

Whichever account you’re after in 2014, shop around. Loyalty doesn’t get you much in the banking industry, so swap accounts if your deal stops being relevant to your needs.

Best Bank Accounts,