You probably saw an advert for the Santander 123 account, a current account which has been widely praised for its ease of use learn more at www.santander.co.uk

Its innovative features, in particular its sector-leading interest rates make of Santander online services a best way to save money easily.

Applying for 123 current account

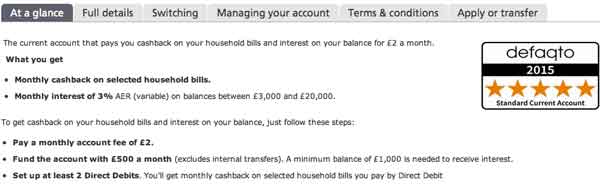

You can apply for this account, at a Santander UK branch or online, provided you are over 18, and a UK resident. A 123 Bank Account requirement is that you pay in a minimum of £500 monthly, and there is an account charge of £2 per month.

How these attractive Santander UK current accounts work?

The 123 Bank Account pays interest on the credit balance at rates between:

- 1 per cent annually for £1.000.

- 3 per cent for a minimum of £3,000, up to a maximum of £20,000.

For basic rate taxpayers, this makes the interest after tax at least comparable with that offered by an ISA.

Find here all 123 account conditions provided by Santander.

Santander account features

The account has the usual range of standing order and direct debit facilities. It can be managed online, but paper statements are also available, as is a chequebook, for those used to traditional banking methods. There is a cash daily withdrawal limit of £300, and for those in credit there are no transaction fees.

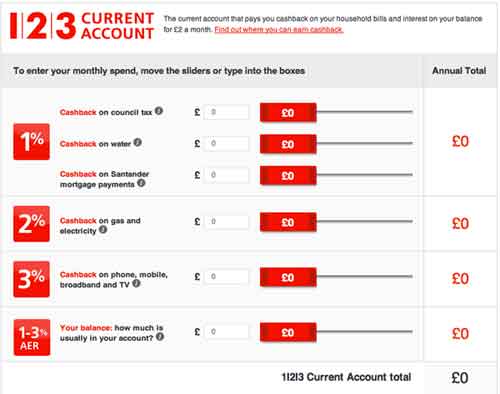

Cashback on direct debits

123 Account holders earn between one and three per cent cashback on various utility direct debits (at a UK address), and even on Santander mortgage payments, so most householders are likely to find that the account fee is much more than offset by cashback payments.

Choose Santander and discover how much you will save each year!

How a 123 Bank Account works for travellers?

Holders of 123 Current Accounts qualify for a thirty per cent discount on travel insurance. Account charges abroad include an Overseas ATM fee of £2, and a £1 fee for overseas debit card use.

Who can benefit from a Santander current account?

Anyone who regularly pays household bills by direct debit, and who can maintain an account balance sufficient to qualify for the excellent interest rate, would do well to open a 123 Bank Account, and perhaps to recommend a friend too.

Contact for your account 123

New customers: 0800 707 6692

Existing customers: 08459 724 724 (also for your credit card steal assistance)

Santander Oxford in london

165, Oxford Street

Postcode: W1D 2JP